By: Matt Sacco

Washington, D.C. – Chase Thompson and his roommate Adam Woodward both have a degree in business administration. Back in February Adam had a steady job as an entry level worker at a Maryland business. In that same month Chase was still working at a local grocery store in his neighborhood.

“If you told me he would be unemployed and I would still have a job a few weeks ago, I would have said you’re crazy,” Chase said in an interview.

Chase’s morning usually starts around 6 a.m. He makes a quick breakfast, hops in the shower, puts on his mask and makes his way out of his apartment, making sure not to wake his slumbering roommate.

When he arrives at his place of work, he usually speaks briefly with his coworkers, maintaining an appropriate six foot distance whenever possible. When the doors officially open, Chase is at the front, using an app on his phone, or an old baseball pitch counter to track how many people are shopping at one time.

“My job is basically to sit there for nearly my entire shift and count how many people come through the door,” Chase said in an interview.

Bagging groceries during a pandemic was never Chase’s desire.

The 22 year old, graduated last year from Virginia Tech with a degree in business administration and moved to DC in hopes of finding a job in this sector.

In that time Chase struggled to find a job, he decided to start working at a nearby grocery store until a good position in his field opened up.

“I had a bunch of different odd jobs over the past years so I didn’t really have a problem working a few days a week. It was at least a source of income.”

A few days turned into five, sometimes six days a week since the pandemic started.

That source of income is one of the few remaining positions in America, and more generally across the world today.

However, even with a seemingly steady source of cash to pay rent and groceries, the future of the two roommate’s housing situation is up in the air.

Chase’s roommate has been without a source of revenue for the past few weeks after he was laid off by his employer.

“I have enough saved up right now, but I’m not sure how long that will all last.” Adam said in an interview.

“If I can’t keep making rent, then we’re both kind of screwed.”

With Coronavirus has come a broad sense of uncertainty. Not knowing when this virus will end, or when or if a vaccine becomes available, has crippled nearly the entire world economy.

“During the Great Recession we lost 8.7 million jobs in the whole thing. Now we’re losing that many every 10 days.” That’s according to an April 26 interview with Kevin Hasset on ABC’s This Weekend, an economic advisor for President Trump.

The Coronavirus pandemic has created a new normal for nearly every person in our world today. Social distancing has kept us six feet apart in an effort to quell this disease from spreading even farther than it has already.

In an effort to prevent mounting deaths, jobs in nearly every non-essential industry have been heavily impacted.

Data released by the bureau of labor statistics paints a picture of unemployment never seen before in the American economy.

Data analysts from the Bureau of Labor Statistics reveal the accelerating nature of the current recession, in comparison to recent economic downturns. About a decade ago, after the 2008 collapse of the subprime mortgage market, and eventual fall of banks across the country and world, we saw the US unemployment figure peak at 10% in October of 2009 according to the Labor Department.

With any recession, economists and government analysts tend to compare research against previous periods of economic misfortune, to help aid in recovery. However, no recession or depression in the past 50 years even scales to the level of unemployment being experienced by Americans today.

During the 2008-2009 recession, we saw unemployment rise to 10.8 percent. However, the rate at which jobs were lost during this period is incomparable to how companies today are hemorrhaging employees at an extraordinary pace.

The unemployment rate after the previous recession took nearly a year, until October 2009, to hit its peak.

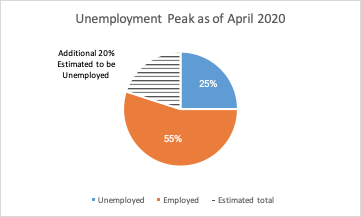

While the federal government is still processing all of the initial jobless claims they have received in the past few weeks due to the fallout from Coronavirus and have not released an official unemployment figure, some publications are reporting Great Depression-era unemployment statistics.

Axios has reported, “The true number of people currently unemployed in the U.S. is likely between 32 million and 70 million, putting the unemployment rate somewhere between 20% and 45%.”

While the figure has been slowly declining in the past few weeks, the figures are still huge. In the week ending April 18, initial claims were estimated to be around 4,427,000.

While government officials have implored people to stay in their homes, many Americans have been forced into the same uncertain situation. For homeowners and renters alike, how long can you afford to pay rent or make payments on your mortgage without a source of revenue?

Protections for homeowners have already been implemented under Maryland’s state of emergency. Foreclosures cannot proceed during the pandemic, which Mary Hunter of the Housing Initiative Partnership in Prince George’s County says “will give homeowners a chance to access unemployment insurance and the stimulus checks. The idea is that it will give a moratorium on foreclosures until everyone can access those resources and hopefully start working again.”

Mary Hunter says the $1,200 stimulus checks provided by the federal government have not arrived quickly, “It’s been slow to arrive in people’s bank accounts, we are just starting to hear from clients that they’re receiving it right now. So it was a little stressful for four weeks and people had not received their stimulus pay.”

While homeowners have received some sort of aid, renters and landlords make up a great percentage of the DMV area and necessitate aid in order to stay afloat.

Matt Losak is the executive director of the Montgomery County Renters Alliance, an organization focused on advocating for renters’ rights and housing affordability.

Losak detailed what protections are necessary considering the DMV area has experienced an influx of renters in the city in just the past 10 years, especially in suburban areas like Montgomery County.

Losak said in an interview, “In 2008, 23% of the county was in rental housing, today it’s nearly 40%. If you look around Rockville, Silver Spring, every green space has an apartment building being built on it.”

“Rent housing became a temporary station on the way to owning, now it’s a way of life. Especially in non-traditional areas like Montgomery County.”

Losak testified before the Montgomery County Council on Tuesday, April 21, lobbying for rent increase freezes across the area.

A rent freeze does not mean a stoppage in landlords collecting rent, instead it is simply a measure to protect renters from landlords who attempt to increase payments during a public health crisis. Additionally, landlords cannot increase rents in a certain time frame after the public health emergency has ended, charge late fees to renters who do not make payments on time or evict any tenants.

Legislation titled the Covid-19 Renter Relief Act passed the Montgomery County Council on April 24, effectively capping increases of rent to 2.6% in Montgomery County and prohibiting landlords from upcharging in the 180 days following the emergency.

Losak says these protections are necessary to protect renters from exposure to the virus as “Any further efforts to destabilize renters, people living in rental housing, would go against the need of the public health emergency to keep people stable in their homes.”

Losak believes an increase in rent and housing instability will only amplify the spread of the virus, “We believe with all rents, any increase can prompt someone to leave their home.”

DC was one of the first metropolitan areas to introduce these rent precautions back in March, with subsequent rent freezes being implemented when the city council passed legislation on April 7.

Without these types of protections being offered by the greater DC and Maryland area, and factoring in no source of income or protections against increasing costs, people could be forced out of their homes and only exacerbate the spread of this virus.

Against the advice of multiple lobbying organizations, Losak says “We are seeing individual landlords going forward with raising rents.” In some cases these increases followed recommended County guidelines for appropriate rent increases which were not enforceable prior to new Montgomery County legislation.

Prior to the relief bill, Losak said, “We were seeing rents increase even more than that, 3%, 5%, and in some cases some gouging going on, with proposed rents of anywhere between 35% and 59%.”

While renters have been provided this relief, landlords who rely on rent payments as a source of income need some leeway and assistance as well.

Losak says “We understand that a landlord needs to get paid and run their apartment complex. Especially smaller landlords who rely on rent payments.”

“On the other hand renters also need to remain stable. So everyone has to sacrifice a little bit.”